CISL report reveals how banks and corporations can better support SMEs on the path to net zero

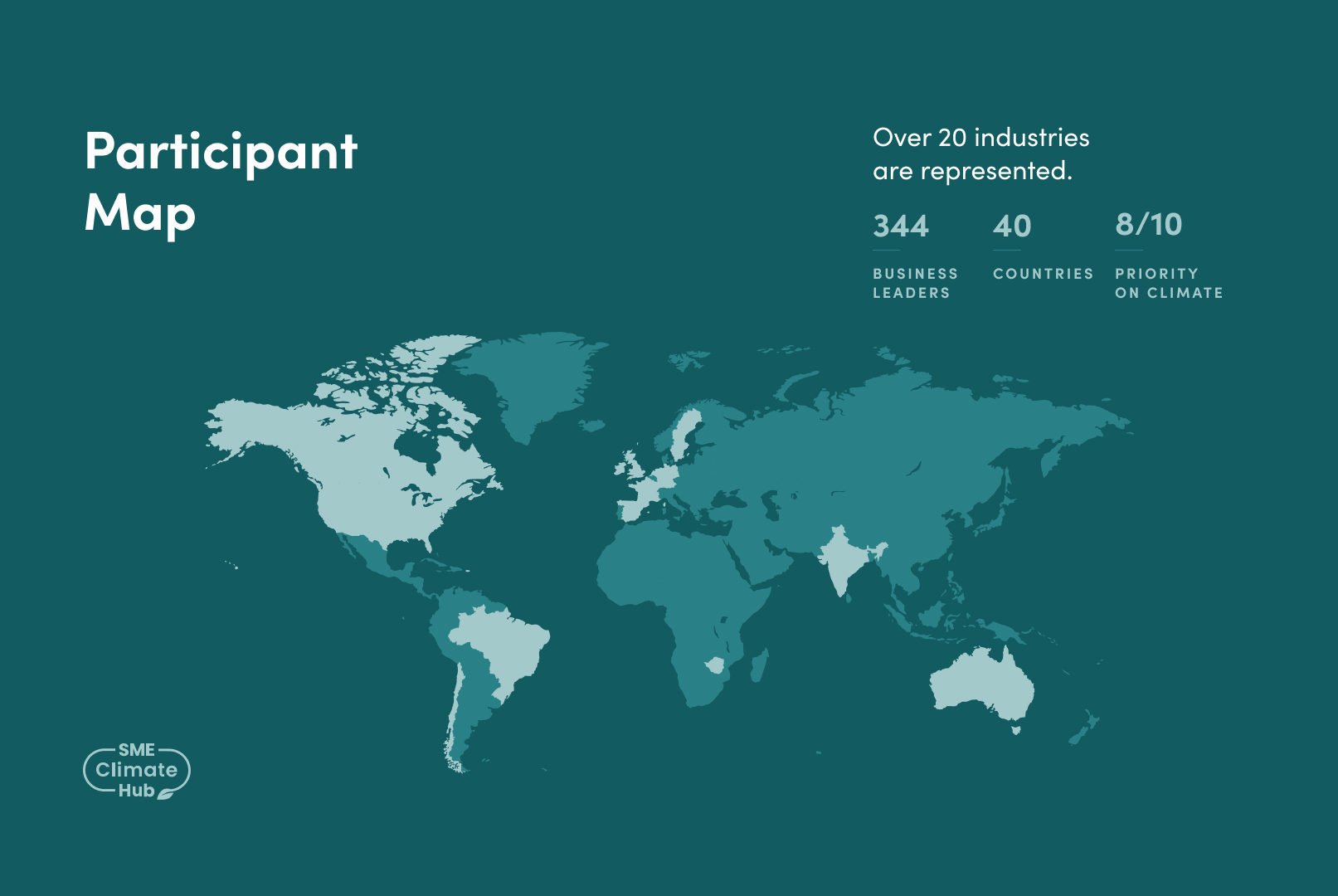

A new report by the Cambridge Institute for Sustainability Leadership (CISL), Business for Social Responsibility (BSR), the We Mean Business Coalition and the SME Climate Hub highlights the role of commercial banks and multi-national corporations in helping small and medium sized businesses (SMEs) reach net zero.

SMEs account for 99 per cent of businesses globally and, in the OECD region, are responsible for more than half of industrial emissions. But the majority of SMEs don’t have the right skills, knowledge, or resources to reduce their carbon emissions. There is a $50 trillion net zero financing gap for SMEs.

HSBC, Barclays, Microsoft and Mastercard, among others, took part in a series of innovation sprints in the summer of 2022 to address barriers SMEs are facing in reducing their carbon emissions. These were short, time-boxed periods where teams worked together to come up with a series of solutions to the financial gap around the net zero transition for small businesses.

The report, Financial Innovation for SME net zero transition: Role of Banks and Buyers, is informed by research undertaken as a part of the SME Climate Hub, a global community and free online resource platform for SMEs looking to transition to net zero, led by the We Mean Business Coalition. The report identifies the obstacles that can hinder SME decarbonisation, from a lack of knowledge and limited time to a lack of standardised guidance on emissions reporting.

It lays out how banks and corporates, those that finance and buy the products and services of SMEs, are well equipped to support net zero action.

Through their own net zero commitments these major players can help bridge the net zero financing gap for SMEs by experimenting with both incremental and radical solutions. ‘It is essential that they do so,’ the report states, alongside ongoing action from policymakers.

Grant Rudgley, Banking Environment Initiative Lead, CISL said: “Small businesses are the backbone of global economies. Supporting them on their journey to net zero is a key priority of their banks, requiring new financial products and advisory solutions. This report begins to meet that requirement, summarising innovations bankers themselves see as necessary and feasible to accelerate small business decarbonisation.”

The potential solutions that emerged from the sprints, co-designed by banks and buyers, and reviewed by SMEs, highlight areas where more can be done. These fall into four categories, including knowledge, technology, behaviour and a shift in business model.

Numerous case studies suggest how this would work. NatWest Group created the NatWest Carbon Tracker application, a knowledge-based solution that provides SMEs with an estimate of their carbon footprint. Equally, Asda has developed a behaviour-based solution called the Sustain & Save Exchange, a free, online tool to support supplier interaction in resource efficiency and emissions reduction.

Giulio Berruti, Director, Climate, BSR said: “Small and medium enterprises make up a significant portion of the world economy, and while their actions are critical to reaching net zero globally, support is currently lacking.

“Most large companies rely on several thousand SME suppliers, and banks often serve large numbers of SME customers. As such, both banks and large companies have an important role to play in incentivising SME action to net zero. I am proud of the work that BSR and CISL did with this report, co-creating solutions that could drastically accelerate the pace of net zero transformation for SMEs.”

Pamela Jouven, Director, SME Climate Hub said: “The SME Climate Hub was founded to help small and medium sized businesses reduce their carbon emissions and access the business incentives of taking climate action. We cannot reach our global net zero goals or create thriving economies without bringing these businesses on board, and they cannot take the action needed without the proper tools and support.”

The report emphasises that these solutions are mutually supportive – stemming from the need for a user-friendly platform dedicated to SME net zero action and uniting around the need for a one-stop platform for banks and buyers too.

Go back

Go back