Online financial support guide for small business emissions reduction launches on SME Climate Hub

The SME Climate Hub has launched the first of its resources, which improve access to financial support for small and medium sized enterprises (SMEs) working to reduce their carbon emissions. The initiative has been developed by Business for Social Responsibility (BSR) and the University of Cambridge Institute for Sustainability Leadership (CISL), as part of the We Mean Business Coalition, a founding partner of the SME Climate Hub.

Small and medium sized businesses are essential to achieving net zero carbon emissions, limiting the worst impacts of climate change, and shifting the global economy towards a sustainable future. SMEs make up over 90% of businesses globally and have the capacity to drive rapid change within the economy. Through their role in supply chains and client portfolios, smaller businesses also form an important part of larger corporations and financial institutions’ indirect (Scope 3) emissions. In order to reach collective net zero goals, it is essential for businesses of all sizes to target emissions reductions.

However, SMEs often lack the resources and time to prioritize climate action. There are two main barriers that hinder SMEs’ ability to reduce their emissions and reap the business benefits of small business climate action:

- Lack of capacity — Daily pressures take the attention of leadership teams that do not have resources explicitly tasked with the climate challenge and opportunity.

- Financial resources — The cost to take climate action may be very high for certain business changes. For example, if an SME selling parts connected to internal combustion engines wants to diversify their revenue away from the supply of those parts, then the investment in people and equipment will be significant.

The new series of financial support tools from the SME Climate Hub aims to bridge this gap, to help SMEs secure long-term viability, improve their profits, and strengthen their climate impact. The net zero transition isn’t just good for the planet – it’s good for business. Climate action provides small businesses with benefits including:

- Supply chain resilience – As large corporations work to reduce their carbon outputs, the small business suppliers following their lead will receive preferential treatment.

- Growth opportunities – Reducing emissions often equates to improved efficiencies, reduced costs, and a publicly strengthened brand. There are also significant opportunities for those smaller businesses able to capitalise on low-carbon innovation and protect themselves against climate-related risks.

- Policy regulations – Limiting carbon emissions will become essential in light of changing policy. SMEs that move ahead of the pack now will see partnership and customer growth as larger corporations grapple with needing to take robust, immediate action. Not to mention it’s the right thing to do.

Financial institutions and large corporates have an opportunity to accelerate the transition and achieve their own net zero commitments by supporting SMEs, which they finance or from which they purchase goods and services. This means a new day is dawning for the relationship between corporates, financiers and smaller businesses.

It is at this juncture that Business for Social Responsibility (BSR) and the University of Cambridge Institute for Sustainability Leadership (CISL) through the Banking Environment Initiative have partnered for a two-year project centered around financial incentives for SMEs. The project is focused on working capital support for SMEs, exploring and detailing how to most effectively engage and financially support SMEs to reduce their emissions footprint. It drives forward the SME Climate Hub’s mission to help small businesses halve their emissions by 2030 and reach net zero by 2050 at the latest.

Supporting SMEs towards finance that can drive their decarbonization objectives.

In 2021, the project identified best practices in SME climate finance and key barriers to scaling and innovating progressive solutions. Our research showed that SMEs do not regard their bank as an entity that can support them during their decarbonization journey: only 4.6 percent of surveyed SMEs would approach their bank for support with designing or delivering an emissions reduction plan.

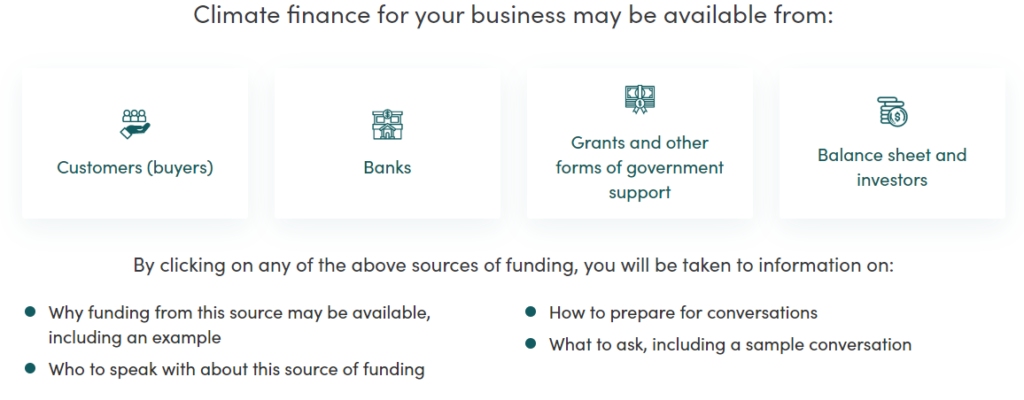

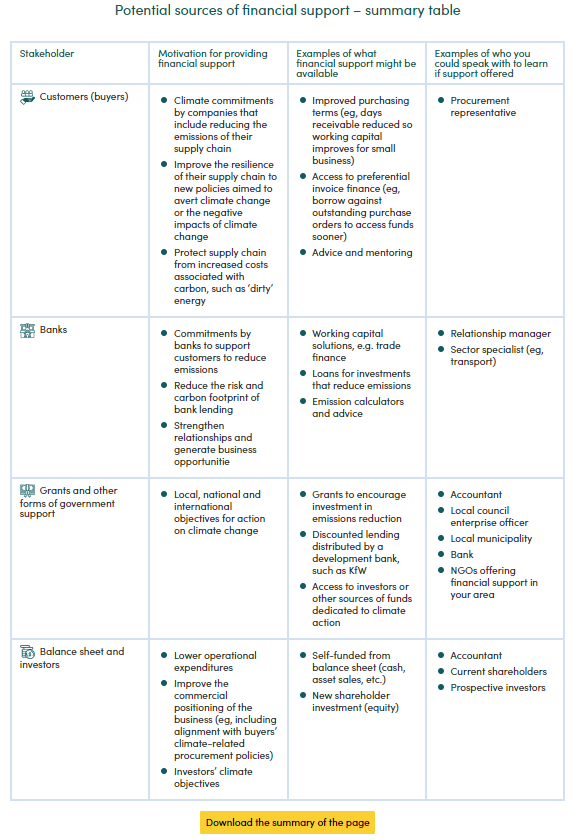

To help spur engagement between financiers and SMEs on this subject, the SME Climate Hub gives access to the online guide for businesses that lays out existing financial support to reduce emissions and how to access this support. The guide details the support available not only from banks and large corporates who buy from SMEs in their supply chains, but public institutions like development banks and a host of others.

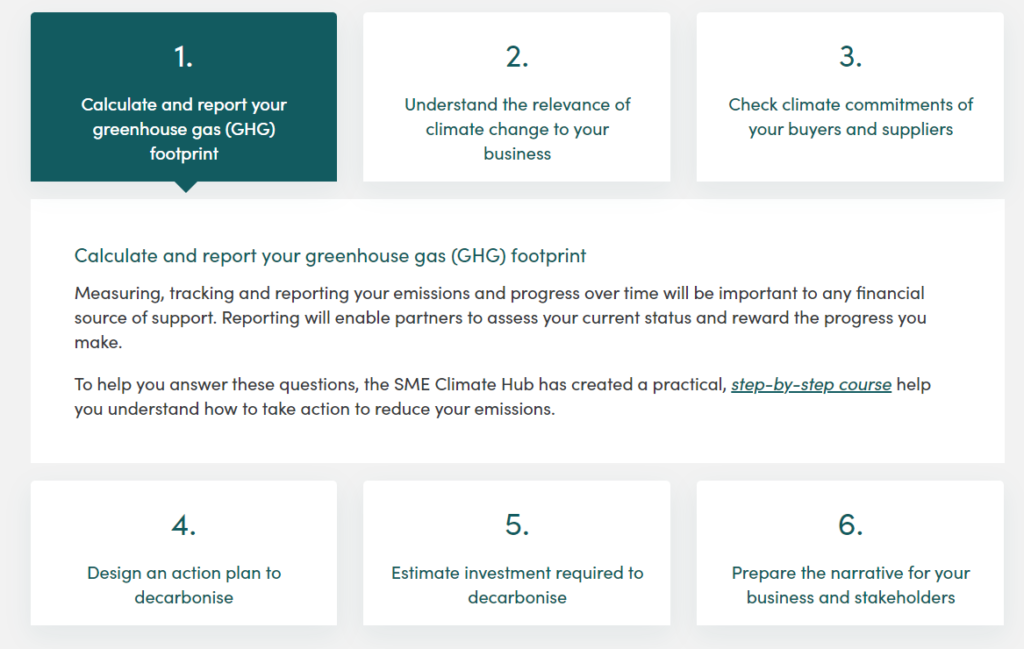

The resource is online and interactive, with excerpts of the guide’s functions shown below:

The guide goes on to suggest steps a small business might consider in preparing for a financing conversation with their financing partners:

The resource also provides:

- Sources of financial support, and

- Business success stories – Hear from SMEs that utilised financial support to make investments that reduced their emissions and enhanced their business. (This includes green loans, advisory and supply chain finance.)

Although some financial support exists, much more can be done to support SMEs in their decarbonisation journey. Moving into 2022, BSR and the CISL are continuing a dialogue with large multinational corporations and leading international banks to explore and scale the financial solutions needed to better facilitate, catalyse and accelerate the global transition of SMEs to net zero.

Make the SME Climate Commitment today to access the Financial Support Guide.

Go back

Go back